Create Webhooks

Instructions for creating and explaining how Webhooks work. Every time a transaction occurs, SePay will fire WebHooks, your sales application will know that the customer has paid and change the order status.

If you need a sandbox environment, please register an account at my.dev.sepay.vn. Here you can create simulated transactions and webhooks for software development purposes. After registration, please contact SePay to activate your account.

Steps to Integrate WebHooks

Step 1: Go to the WebHooks menu

Step 2: Click the + Add webhooks button at the top right

Add webhooks Step 3: Fill in all required information, including:

- Name: Any name you want

Select Event: You can choose to trigger WebHooks when money in, money out, or both

Select Conditions: Including:

- When bank account is: Choose the bank account(s) for which WebHooks will trigger. If you want to specify virtual accounts (VA) to receive notifications, check Filter by virtual account and select the desired VA accounts.

- Ignore if transaction content does not contain payment code: If selected, SePay will NOT send WebHooks if the payment code is not detected in the transfer content. > TIP: Configure payment code recognition under Company → General Settings → Payment Code Structure

WebHooks Attributes: Including:

- Call URL: The link where WebHooks will be sent. If you want to build a website to receive webhooks, see the guide here.

- Is this a payment verification WebHook?: Select Yes if this WebHook is used to verify payments for your website/application.

- Retry WebHook when: SePay supports certain conditions to automatically retry WebHooks when:

- The HTTP Status Code is not between

200and299.

- The HTTP Status Code is not between

WebHooks Authentication Configuration: Including:

- Authentication Type: SePay currently supports OAuth 2.0, API Key, or No authentication.

- If OAuth 2.0 is selected, fill in OAuth 2.0 Access Token URL, Client ID, and Client Secret.

- If No authentication or API Key is selected, choose Request Content Type as

application/json,multipart/form-data, orapplication/x-www-form-urlencodedaccording to your receiver application.

- Authentication Type: SePay currently supports OAuth 2.0, API Key, or No authentication.

Step 4: Click [Add] to complete integration.

WebHooks Payload Data

- SePay sends a POST request with the following JSON payload:

{

"id": 92704,

"gateway": "Vietcombank",

"transactionDate": "2023-03-25 14:02:37",

"accountNumber": "0123499999",

"code": null,

"content": "transfer to buy iphone",

"transferType": "in",

"transferAmount": 2277000,

"accumulated": 19077000,

"subAccount": null,

"referenceCode": "MBVCB.3278907687",

"description": ""

}- Parameter Explanation

| Name | Type | Required | Description |

|---|---|---|---|

id | integer | Required | Transaction ID on SePay |

gateway | string | Required | Bank brand name |

transactionDate | string | Required | Transaction time from the bank |

accountNumber | string | Required | Bank account number |

code | string | Not required | Payment code (automatically detected by SePay based on settings in Company → General Settings) |

content | string | Required | Transfer description |

transferType | string | Required | Transaction type. 'in' means deposit, 'out' means withdrawal |

transferAmount | integer | Required | Transaction amount |

accumulated | integer | Required | Account balance (accumulated) |

subAccount | string | Not required | Sub-account (virtual account) |

referenceCode | string | Required | Reference code from SMS |

description | string | Required | Full SMS message content |

Webhooks authentication types:

- No authentication: SePay does not send a header

- API Key: SePay will send with the header

"Authorization":"APIkey_API_KEY_YOU" - OAuth2: See OAuth2 configuration guide for Webhooks integration

Testing WebHooks

If using a Demo account, go to Transactions → Simulate Transaction to create a new test transaction. See details about Simulate Transaction here.

If not using a demo account, you can test by sending a small amount to trigger a real transaction.

Then go to Logs → WebHooks Log to view sent WebHooks.

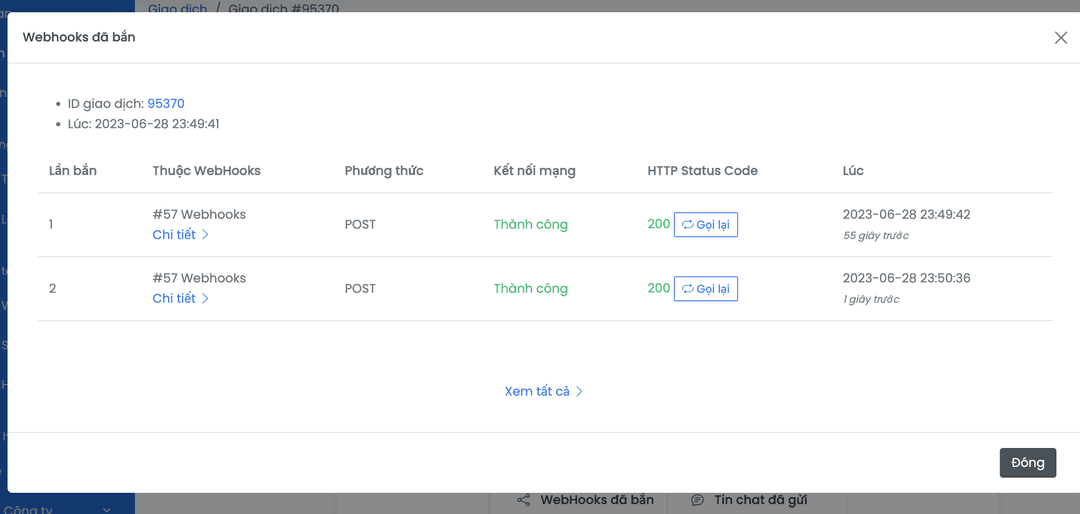

You can also view the WebHooks message per transaction at ⇆ Transactions → Auto column → select Pay.

Recognizing Successful WebHooks

When receiving a WebHook from SePay, your website must respond as follows for SePay to mark it successful:

With OAuth 2.0 authentication (See OAuth2 configuration guide for Webhooks integration)

- The response body must be JSON containing

success: true:{"success": true, ....} - HTTP Status Code must be

201

- The response body must be JSON containing

With API Key authentication

- The response body must be JSON containing

success: true:{"success": true, ....} - HTTP Status Code must be

201or200

- The response body must be JSON containing

Without authentication

- The response body must be JSON containing

success: true:{"success": true, ....} - HTTP Status Code must be

201or200

- The response body must be JSON containing

If the response does not meet the above conditions, SePay will consider the webhook failed.

Automatic Retry for WebHooks

SePay will retry WebHooks if the network connection to the webhook URL fails. Additionally, you can configure retry conditions supported by SePay. The retry intervals follow the Fibonacci sequence.

- Maximum retry attempts: 7

- Maximum total retry duration: 5 hours from the first failed attempt

- Network connection timeout: 5 seconds

- Maximum response timeout: 8 seconds

NoteSePay will NOT retry a webhook if the connection is successful but the webhook status is failed, unless the retry conditions you set are met.

Preventing Duplicate Transactions

To avoid duplicate transactions in case of retry issues, SePay recommends implementing duplicate transaction prevention in your webhook receiver.

Validate the uniqueness of the

idfield, or combine it with fields such asreferenceCode,transferType, andtransferAmountfrom SePay's payload to ensure transaction uniqueness.

Manual Retry for WebHooks

- You can manually trigger a webhook retry by going to Transaction Details → View Sent WebHooks → Retry, or by visiting the WebHooks Log and selecting Retry.